Complete product range

Source manufacturer

Quality assurance

Customizable production

“诚实良善 相融共赢”的核心价值观

公司生产的净化板、华体会体育大厅 等产品畅销30多个国家和地区

HTH官网商城

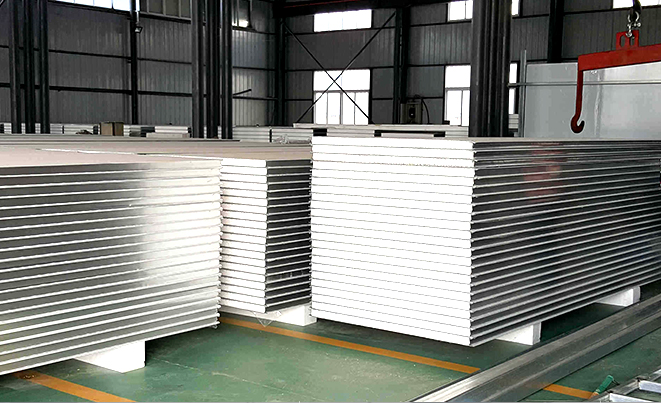

,多年的发展,公司现已发展成为集建筑钢品设计、生产、贸易、科研于一体的大型民营集团化企业。主营净化板、华体会体育大厅

、医疗洁净板、洁净板材、彩钢板、岩棉净化板等保温材料。

多年来,公司本着 “真实 简单 立行 共赢”的企业精神, 在“诚实良善 相融共赢”的核心价值观指引下,通过多年的不懈努力和执着追求,得到了顾客和社会的一致认可...

Support customization

Mass production

Construction Major

Meticulous service

多重优势 让您定制无忧

经验丰富设计团队,根据产品特性需求 量身设计产品,保护产品安全。

10余种版型,30余种芯材,一站式购齐,无需二次寻找其他生产厂家。

板面色泽鲜艳、平整美观,质地轻,隔音性能好,耐水性好,耐高温。

全产业链生产,自动化程序高,助力企 业降低采购成本。

电 话:

电 话:

地 址:山东省

地 址:山东省